Chase Bank is one of the largest financial institutions in the United States, offering thousands of consumers across the country. As a Chase customer, you may be knowledgeable along with their range of financial services, consisting of checking out accounts. One important facet of having a checking account with Chase is knowing how to make use of and handle your examinations adequately. Listed below are Check Here For More and don'ts when it happens to using Chase inspections.

Do: Keep keep track of of your chequebook equilibrium

One important element of utilizing inspections is keeping track of your check book equilibrium. Produce certain to videotape each examination you write in your inspection sign up, along with any type of down payments or drawbacks you help make. This technique, you can keep an precise record of your spending and stay away from overdraft fees or bounced checks.

Don't: Write inspections without sufficient funds

It might be alluring to write a examination for an quantity that surpasses your offered equilibrium in hopes that the down payment will remove before the check performs. Nevertheless, this technique can easily lead to overdraft expenses and harm your credit report rating. It's always finest to possess ample funds readily available when writing a examination.

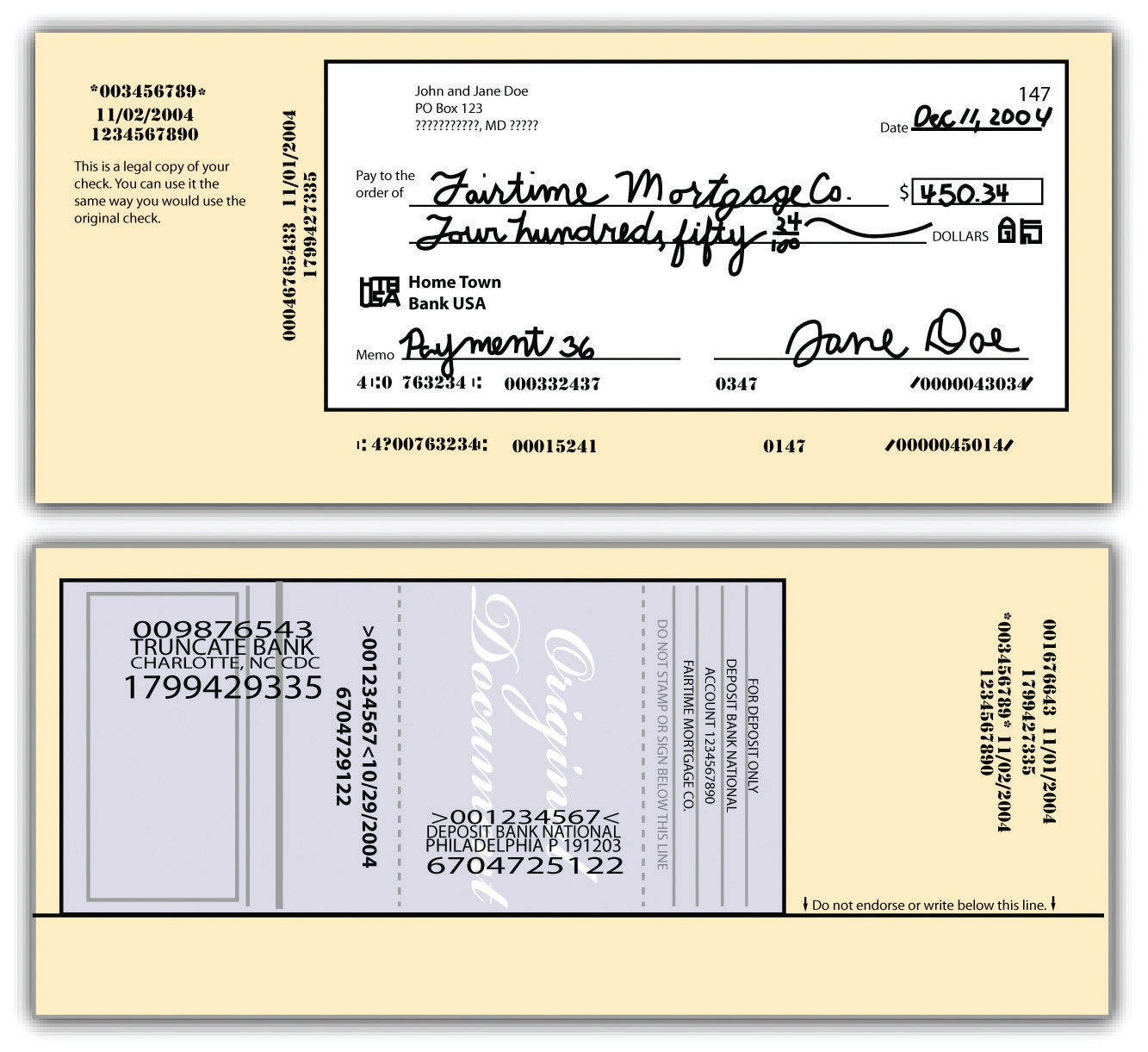

Do: Authorize each examination properly

When writing a inspection, it's vital to authorize it appropriately. Your signature offers as verification that the funds are authorized for withdrawal coming from your profile. A missing or incorrect signature can easily result in decreased deals or other problems.

Don't: Leave behind empty spaces on the examination

Leaving behind blank rooms on a check can easily leave behind space for someone else to fill up them in with an unapproved quantity or payee name. To prevent fraud, consistently fill out all industries on the examination totally and efficiently.

Do: Use dark ink when writing checks

Utilizing black ink guarantees that the details on your inspections is clear and conveniently reviewed through banks and various other financial companies during processing. Blue ink might not be as effortless to checked out, leading to hold-ups or inaccuracies in processing.

Don't: Post-date a check

Post-dating a inspection implies writing a potential date on the check as an alternative of the current time. While this technique may seem to be safe, it can lead to complication and issues along with processing. It's finest to write the present date on your examinations.

Do: Maintain your examinations in a safe location

Storing your inspections in a safe place is essential to avoid them from falling in to the wrong hands. Take into consideration keeping them locked away or in a fire resistant safe.

Don't: Discuss your personal details

Certainly never share your private relevant information, such as account amounts or social safety varieties, with anyone you don't rely on. Scammers may make use of this information to swipe your identification and devote illegal tasks.

In verdict, using Chase checks comes with its personal collection of dos and don'ts that you should be aware of to stay away from any kind of problems or problems. By observing these tips, you can guarantee that your transactions are refined effectively and safely while protecting yourself coming from fraudulence or overdraft fees. Always r